In the three years since we published our inaugural European Expansion Report, we’ve experienced a devastating global pandemic and substantial economic volatility.

Many venture-backed startups have shied away from – or abandoned outright – the ‘growth at all costs’ mentality, instead favoring extreme focus on efficient growth and controlling costs.

For U.S. software startups with international ambitions – namely, capturing share of the European SaaS market – shelving expansion for a later date would be a big mistake.

As we release our 2023 European Expansion Report, the data holds true: Europe is a critical growth market, right now.

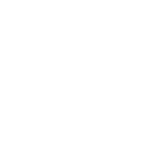

One of the most telling findings from our 2023 report is the revenue contribution from Europe for U.S.-based software companies at IPO.

Top performing companies are driving up to 40% of revenue from Europe, but there’s a wide distribution, as weaker performing companies generate under 10%.

With over 740 million people and an $18 trillion GDP, Europe is a massive market opportunity – one that represents one-third of all global revenue for public software businesses. And yet, the majority of companies aren’t capturing this value.

De-prioritizing European expansion is often driven by a fear of the unknown. Since we’re operating in a capital-constrained environment, many CEOs and Boards have understandably allocated capital towards growth initiatives that feel more comfortable and familiar.

But the truth is, these initiatives can actually be higher risk than a European expansion. Expanding into Europe is about disciplined execution, not high-risk innovation.

Because expansion involves importing a proven product and GTM motion from the U.S. into a new geography, it’s actually lower risk than expanding into a new customer segment (which involves developing a whole new GTM motion) or expanding your product footprint (which involves building a set of brand new features and determining how to sell them).

Elite founders and CEOs – especially those who have built international businesses before or have international experience on their Board – are actively prioritizing European expansions right now.

Take for example, Frontline portfolio company Vanta, a U.S.-based security and compliance company that is aggressively investing in the region and growing even during the current downturn.

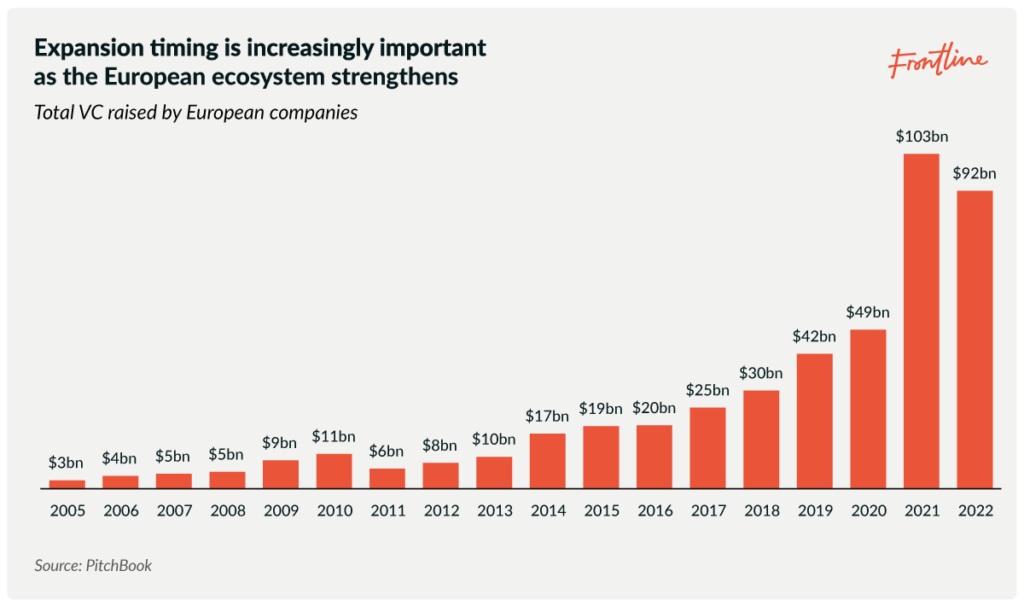

And it’s a good thing these leaders aren’t hesitating, because the consequences of delaying European expansion are higher than ever: Venture capital raised by European companies has increased 10X over the last decade, scaling to over $90B in 2022, and the number of new companies being funded in Europe is nearly on par with the U.S.

This increased availability of capital and the strengthening of the European startup ecosystem has raised the stakes, making the decision on when to expand to Europe more critical than ever.

Timing and conditions couldn’t be more ideal for U.S.-based software companies to expand into Europe.

Not only is it necessary for staving off increasingly savvy European competitors, but companies with European revenues are arriving at IPO growing 5% faster year-on-year than they would with their U.S. business alone.

For any CEOs still grappling with the idea of European expansion, here are four actions that can help determine readiness:

- Evaluate the maturity of your U.S. organization. If your executive team is strong and experienced, your GTM motion is repeatable and you’re already seeing inbound demand from Europe, then it’s likely the right time to expand. (Typically, we see companies reach 8-12% of revenue share from Europe organically, but growing that to 30%+ takes strategy, investment, focus and execution).

- Run a robust market prioritization exercise. Europe includes many individual markets, all with their own unique characteristics. Don’t try to move into too many new European markets at once; tier and sequence your expansion strategy.

- Build a comprehensive market entry plan. This should be a three year plan that details the level of investment required. Identify success metrics to unlock incremental investments as you identify things that are working. And tap experts with European expansion experience, as they’ll have benchmarks and be able to provide feedback on the viability of your plan.

- Decide to fully commit or cut the cord. Don’t make a halfway compromise here. Underinvesting in a European expansion might yield initial revenue gains, but you won’t be able to build a platform that succeeds over the longer term by taking shortcuts.

Ultimately, successful European expansion requires a growth mindset and culture shift at your U.S. HQ – starting with the CEO.

I witnessed this firsthand while at Google, Yammer and SurveyMonkey. We found success because our CEO got excited and got on a plane: executives rotated through the new region and our U.S.-based teams traveled to transfer best practices and build our culture in-person.

Expansions are personal, it can’t be delegated to a regional leader, especially considering how difficult it is to get that first senior hire right: Our data show that nearly half (47%) of EMEA General Managers depart within just two years.

If you’re a high-growth CEO operating in the B2B software space, I encourage you to read the full European Expansion report. It proves that capturing European market share is the first, crucial step in globalizing your company to fulfill its true potential.

The past three years have been volatile, but there’s never been a better time to expand into Europe for top performing startups. Wait, and you risk conceding valuable market share to high-quality local competitors, and in today’s capital environment, avoiding costly mistakes is absolutely critical.